do nonprofits pay taxes in canada

Having to register as a charity is easier for charities under the Canada Revenue Act as they can be distinguished from non-profits. Human Resources Coordinator.

Accounting And Bookkeeping For Non Profit Organizations Npo Green Quarter Consulting Surrey Bc

Although nonprofit organizations in Canada do not have to pay income taxes they do have to submit their tax returns with the Canada Revenue Agency.

. While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes Social Security and Medicare just like any for. Taxes Nonprofits DO Pay. The federal government would allow you to claim.

Tax time can be stressful for nonprofit and charitable organizations in Canada especially when the filing requirements are not well understood within the organization. Most nonprofits do not have to pay federal or state income taxes. But nonprofits still have to pay.

Your recognition as a 501 c 3 organization exempts you from federal income tax. NPOs do not have to pay taxes but they may have to submit Form T1044 Non-Profit Organization Information Return. First and foremost they arent required to pay federal income taxes.

They must pay payroll tax all sales and use tax and unrelated business income. By contrast an organization that is incorporated under the Canada Business Corporations Act is generally referred to as a business corporation. Non-profits that are not registered charities may have to file a T2 corporate return if they are incorporated andor an information form T1044.

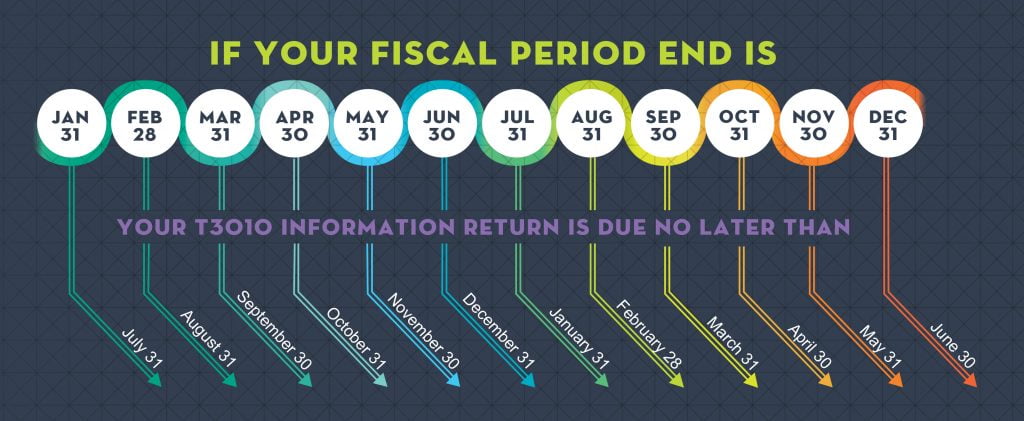

Must be established and operate exclusively for charitable purposes. The Non-Profit Information Return form T1044 due no later than six months after the end of your fiscal year is often overlooked by NPOs. While nonprofits typically will not have to pay taxes they still have to submit annual tax returns with the IRS.

GSTHST Information for Non-Profit Organizations. Do Not For Profit Pay Taxes In Canada. Yes nonprofits must pay federal and state payroll taxes.

CRA can assess penalties of 25 per. Our publications and personalized correspondence are available in braille large print e. As such the applicability.

What Can a Non-Profit Organization Pay Out to its Members. By QuickBooks Canada Team. Helping business owners for over 15 years.

Generally non-profits are exempt. There are many variations in the requirement for nonprofits to file tax returns based on certain elements such as type of business and financial status. If your NPO has received or is eligible to receive taxable.

There is no requirement. 15 credit on the first 200 30 29 credit on the remaining 300 87 Then the Alberta government would allow you to claim an additional. However here are some factors to consider when.

48127 USD 47576 CAD Recruitment hiring screening compensation and workplace safety are vital to developing a nonprofit team. A recent CRA ruling conveniently breaks down some of the rules about. Non-profit organizations whose primary purpose and operation is related to the promotion of amateur athletics in Canada is exempted from this rule.

Do nonprofit organizations have to pay taxes. March 29 2017 2 min read. Being tax exempt means an organization doesnt pay federal.

Can operate for social welfare civic improvement pleasure sport recreation or any other. Nonprofits and churches arent completely off of Uncle Sams hook. Thus where an organization intends at any time to earn a profit it will not be exempt from tax under paragraph 149 1 l even if it expects to use or actually uses that profit.

Charities and not-for-profit organizations are not always exempt from property tax despite being exempt from income tax under the Income Tax Act Canada ITA. Canadian nonprofits do not need to pay income tax but these organizations still have to file a return with the Canada. Not-for-profit corporations are not.

In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of.

Budget 2020 What S The Sector Asking For Imagine Canada

A Short History Of Voluntary Sector Government Relations In Canada Revisited The Philanthropist Journal

Rules Of Engagement The Nonprofit Vote

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Four Reasons The Nonprofit Sector Needs A New Name Onn

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

Simple Ways To Start A Nonprofit In Canada With Pictures

Sources And Uses Of Incomes In The Nonprofit Sector

Simple Ways To Start A Nonprofit In Canada With Pictures

How To Start A 501c3 Ultimate Guide To Registering A 501c3 Nonprofit Doctors Note Template Doctors Note 501c3

Canada S Nonprofit Sector In Economic Terms

Sources And Uses Of Incomes In The Nonprofit Sector

Guide To Gst Hst Information For Nonprofit Organizations Enkel

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

Maine Budget Proposal Includes Controversial Tax Changes For Large Nonprofits Canadian Call Centre Ivr Web Chat And E Mail Response Solutions Fun Fundraisers Nonprofit Fundraising Non Profit

Simple Ways To Start A Nonprofit In Canada With Pictures

Infographic On Charitable Giving In Canada From Imagine Canada Http Www Imaginecanada Ca Node 802 Infographic N Charitable Giving Infographic Charitable

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)